As the United States commemorated its 200th anniversary in 1976, a special series of coins was issued to mark the occasion: the Bicentennial Coins. These coins, which include the quarter, half dollar, and dollar, were designed with unique reverse designs to celebrate America’s rich history. Forty-eight years later, investors and collectors alike are revisiting these coins with renewed interest. But is now the right time to invest in Bicentennial Coins? Let’s delve into the factors influencing their investment potential.

The Bicentennial Coin Series: A Brief Overview

The Bicentennial Coin series includes three distinct coins:

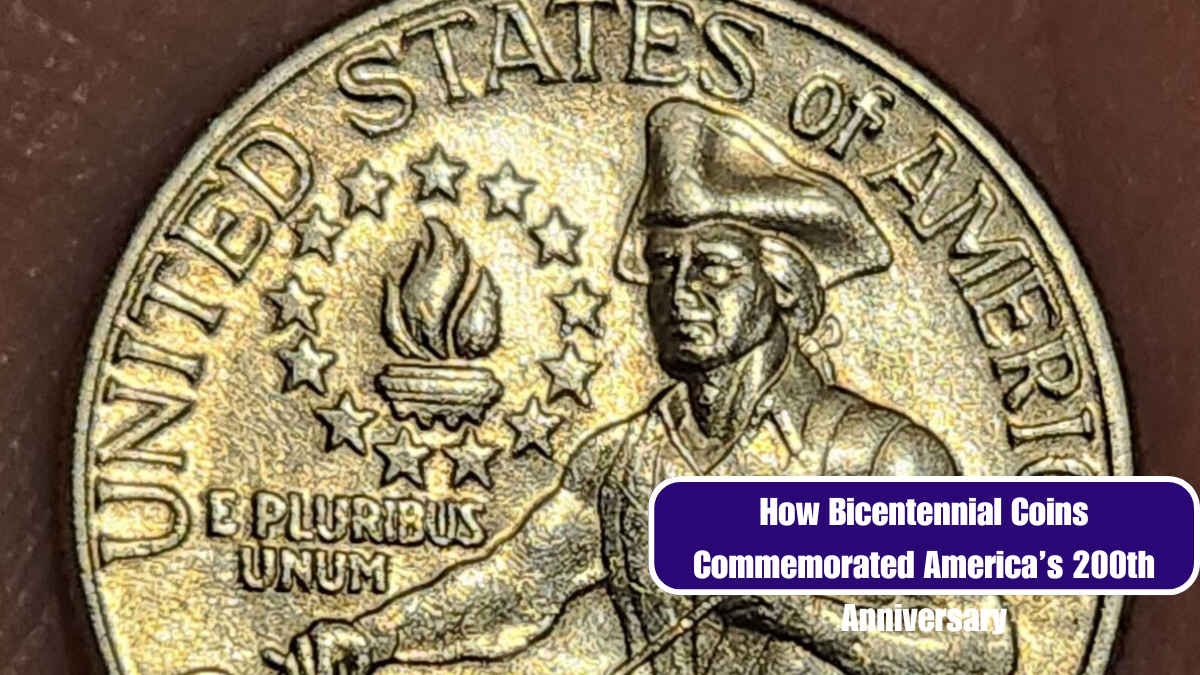

- Quarter Dollar – Featuring a depiction of Colonial drummer boys, designed by Jack L. Ahr.

- Half Dollar – Showcasing the Liberty Bell superimposed on the moon, designed by Dennis R. Williams.

- Dollar Coin – Illustrating the Liberty Bell and the moon together, designed by Seth G. Huntington.

These coins were minted in 1975 and 1976, with the unique reverse designs only appearing on the 1976 versions. They were produced in both silver and clad varieties, with the silver versions containing 40% silver.

Historical Performance and Current Value

Initially, Bicentennial Coins were released to replace regular issues in circulation and were not intended to be rare. As a result, their general availability led to a lower market value, particularly for those in circulated condition. However, mint sets and uncirculated versions have gained some traction among collectors and investors due to their historical significance and unique designs.

The value of these coins largely depends on their condition and type. Uncirculated and proof coins in pristine condition have consistently held higher value compared to their circulated counterparts. Silver versions, due to their metal content, generally fetch higher prices than their clad counterparts.

Market Trends and Investment Potential

In recent years, interest in Bicentennial Coins has seen a modest increase. Several factors contribute to this trend:

- Historical Significance – As time passes, historical commemoratives often gain value as they become nostalgic artifacts of American heritage.

- Silver Content – The silver coins are appealing to those who value precious metals as a hedge against inflation and economic uncertainty.

- Collector Demand – The appeal of Bicentennial Coins is also driven by their unique designs and the desire of collectors to complete sets of commemorative issues.

Despite these factors, the investment potential of Bicentennial Coins should be approached with caution. The market for commemorative coins can be volatile, and values may not always appreciate significantly. It’s important for potential investors to consider:

- Coin Condition – Coins in mint state or higher are more likely to see appreciation.

- Market Saturation – The sheer number of Bicentennial Coins minted may limit their scarcity and potential for high returns.

- Long-Term Horizon – Like many collectibles, the value of these coins may increase over a longer period.

When to Buy?

If you’re considering investing in Bicentennial Coins, here are some tips:

- Research – Understand the specific type of coin you are interested in, and check recent auction results and market trends.

- Buy Quality – Focus on high-quality, uncirculated, or proof versions, and be wary of coins in poor condition.

- Diversify – Consider including Bicentennial Coins as a part of a broader investment strategy that includes other assets and collectibles.

Bicentennial Coins, while not the most valuable or rare of American commemorative coins, offer a unique blend of history and investment potential. Their value is influenced by their condition, the silver content, and collector interest. For those interested in historical coins and willing to hold their investment over the long term, now could be a prudent time to consider adding these coins to your collection. However, as with any investment, thorough research and careful consideration of market conditions are key.